Dear Client

RBA DELIVERS MARCH CASH RATE DECISION

It’s the first-rate decision to be handed down outside of the previous ‘first-Tuesday-of-the-month’ announcement pattern.

In its second meeting for 2024, the Reserve Bank of Australia (RBA) has opted to hold the cash rate at 4.35 per cent.

The decision to keep the cash rate at 4.35 per cent was widely expected from economists and forecasters the country over.

According to Oxford Economics Australia’s head of macroeconomic forecasting, Sean Langcake, the Australian economy is enduring “a policy-induced slowdown.”

He believes “both fiscal and monetary policy are at or close to the peak frag they will impose on the economy in this cycle.”

“Still, with cost pressures proving to be persistent and elevated, the lingering inflation problem has not yet been cured.”

Just days ago, the Commonwealth Bank of Australia’s head of Australian economics, Gareth Aird, considered the RBA’s March rate deliberation to “be a very straightforward decision.”

Explaining that the case to increase rates any further would be a “weak” one, he explained: “Any further tightening from this juncture simply runs the risk of a ‘hard landing’ – something the RBA has wanted to avoid through their tightening cycle.”

ANZ, Westpac and NAB were also all expectant of a hold pre-announcement, while RateCity was also expectant of rates remaining at 4.35 per cent.

RateCity research director Sally Tindall had acknowledged the “holding pattern” currently being run by the RBA, due to a continuing drop in trimmed inflation alongside the rise in

unemployment seen across January which would have a continued impact on the central bank’s decision-making.

“While the Board is likely to play it safe by continuing to warn Australians more rate hikes cannot be ruled out, the reality is the RBA’s next move is far more likely to be down, rather than up,” she remarked.

She went so far as to warn borrowers that they “should not expect official rates to budge any time soon.”

“In fact, if you’ve got a mortgage, assume the cash rate won’t be coming down until well into 2025, just to be on the safe side,” Tindall flagged.

“This means borrowers with a mortgage need to ready themselves for a financially tough remainder of the year.“

While mortgage-holders may not yet be out of the woods, the decision to keep rates on hold will bode well for market confidence, and reassure mortgage holders of the likelihood that the RBA has likely completed its extended cycle of hikes and lead to more stable conditions, according to LJ Hooker Group head of research, Mathew Tiller.

Tiller shared that with the continuation of strong auction clearance rates bodes well as evidence of buyer demand, and can be attributed, in part, to the fact that “everyone is looking for affordability at the moment.”

“This is boosting the middle to lower priced end of the market.”

Also stressing the fact that the RBA’s decision to hold rates at 4.35 per cent was not unexpected, he pointed to the “cooler economy along with reduced inflation and cost of living pressures easing.”

With stronger market confidence seen across the first three months of 2024, and with increased activity anticipated through Autumn, Tiller went on to highlight how “those who are continuing to struggle with higher interest rates are also looking to list because they are more comfortable doing so now that we have seen prices rise for 13 consecutive months.”

Arguing that the longer the RBA holds rates steady, the more confidence people will have they are not going any higher, he opined that “people will be comfortable within their household budgets and repayments, particularly as wage growth outpaces inflation.”

“As we get further to the second half of the year and there is more talk of rate cuts that will boost confidence and sentiments from both buyers and sellers,” the researcher concluded.

RBA delivers March cash rate decision – Smart Property Investment

PRELIMINARY CLEARANCE RATE HOLDS UP UNDER HIGHER SUPPLY

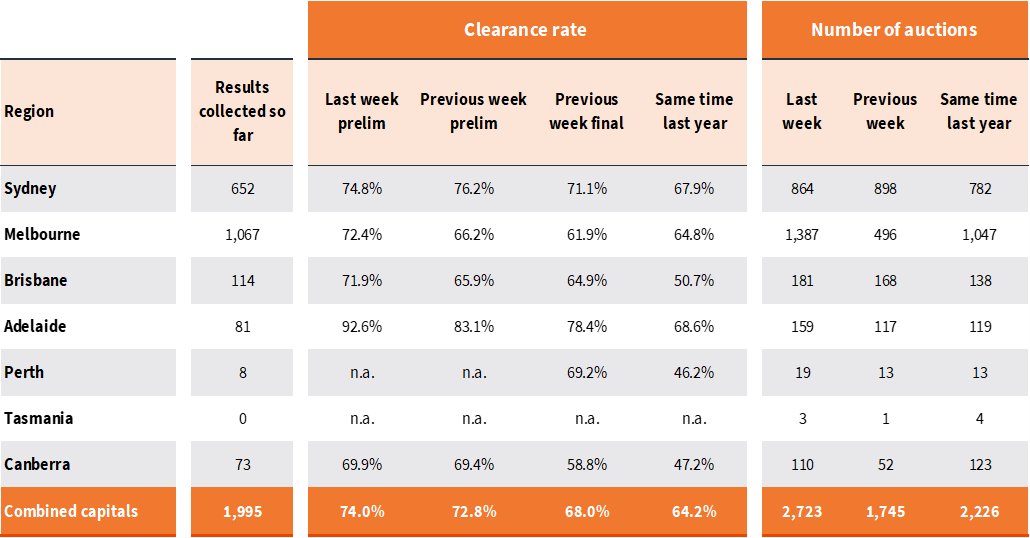

With 2,723 capital city homes going under the hammer last week, it was the second busiest week of auctions so far this year. The preliminary clearance rate held up well under higher supply, coming in at 74.0%, 1.2 percentage points higher than the previous week’s preliminary clearance rate (72.8% which revised down to 68.0% on final numbers).

Sydney was the only capital city to record a lower preliminary clearance rate, with 74.8% of auctions returning a successful result so far, down from 76.2% over the previous week (revised down to 71.1% on final numbers) and the lowest preliminary clearance rate so far this year. Although the trend in clearance rates has been softening across Sydney, the success rate remains above the decade average of 72.2% on the preliminary rate and 68.1% on the final rate.

Melbourne’s preliminary clearance rate recorded a solid bounce back, rising to 72.4%, after the previous week’s long weekend saw the preliminary clearance rate drop to 66.2% (revising down to 61.9% on final numbers). Last week’s early result was the second highest so far this year, after the second week of February (73.1%). With 1,387 auctions held, this was also the second highest number of auctions held so far this year.

The preliminary clearance rate was up across the smaller capitals as well, led by Adelaide with a stunning 92.6% preliminary clearance rate. Brisbane’s clearance rate came in at 71.9%, while Canberra’s preliminary clearance rate came in at 69.9%. There were 181 auctions held across Brisbane last week, 159 in Adelaide, 110 in Canberra and 19 in Perth. Four of the eight auctions reported in Perth so far were successful, while we are yet to receive the results of the three auctions in Tasmania.

This week (i.e. the week before Easter) is looking huge for auctions, with around 3,400 homes currently scheduled to go under the hammer. It’s rare to see more than 3,000 capital city auctions in a week… in fact, if the scheduled volume of auctions holds at this level, this week is likely to be the largest volume of auctions held since the week prior to Easter in April 2022.

Capital City Auction Statistics (Preliminary)

Preliminary clearance rate holds up under higher supply | CoreLogic Australia

Thank you for your ongoing support!

Regards David, Benjamin & the Team at DB Philpott Real Estate