Dear Client

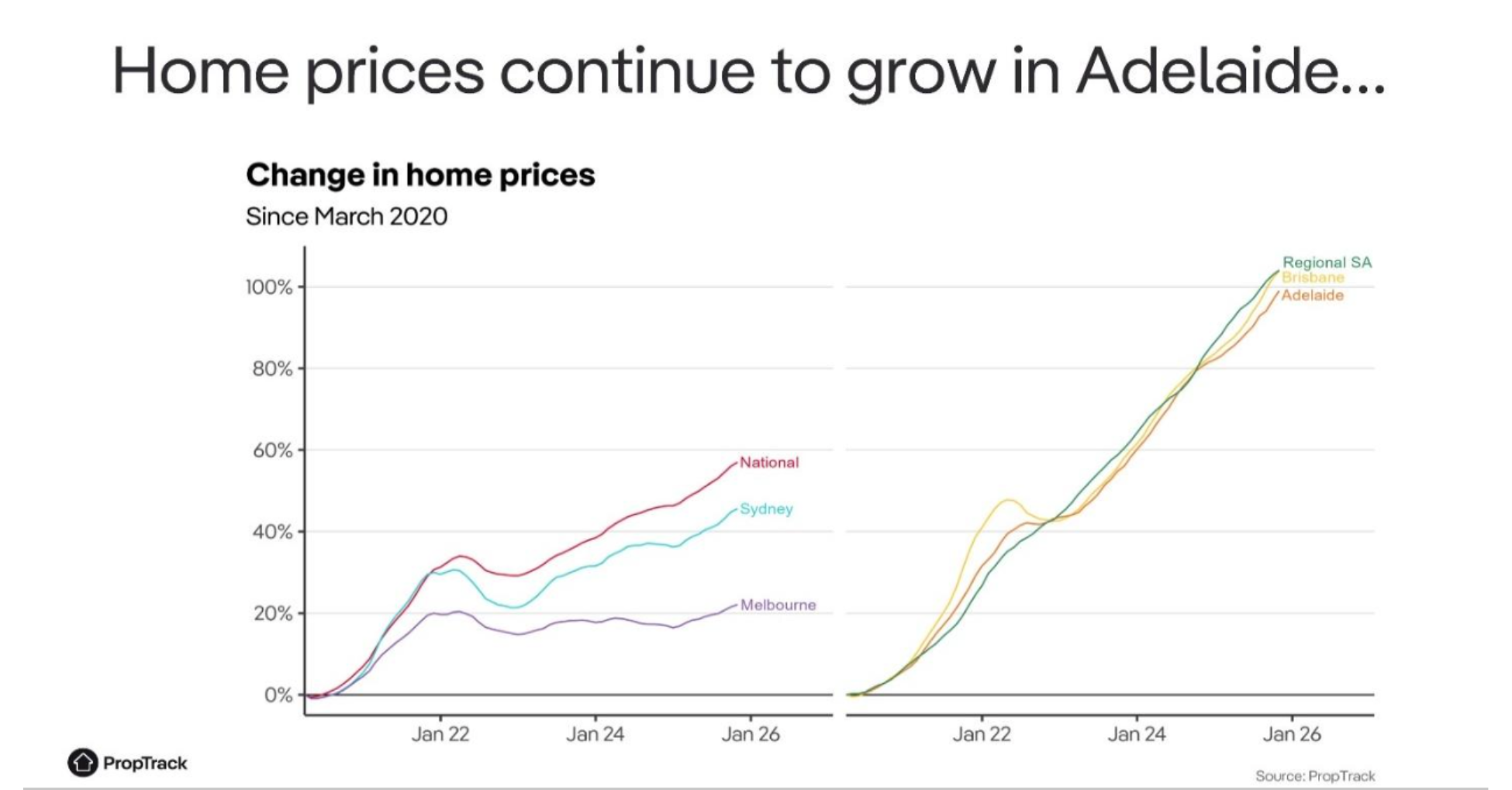

As we move through November 2025, both Adelaide and the broader Australian property market continue to demonstrate remarkable resilience. Despite affordability pressures and a challenging interest rate environment, demand remains strong and supply constrained thus creating favourable conditions for landlords and long-term investors.

ADELAIDE MARKET HIGHLIGHTS

- Strong Growth: Adelaide home values rose 1.4% in October, the sharpest monthly gain since mid-2024.

- Affordable Segment Leading: Lower quartile properties surged 9.6% annually, reflecting strong demand for affordable housing.

- Supply Shortage: Listings remain 36% below the five-year average, keeping upward pressure on prices.

- Investor Confidence: Adelaide is firmly in the rising phase of the property clock, with momentum expected to continue into 2026.

NATIONAL MARKET OVERVIEW

- Broad-Based Growth: Australian home values rose 1.1% in October, pushing annual growth to 6.1%.

- Demand vs Supply: Home sales are 3.1% above average, while advertised supply is 18% below average.

- Interest Rates: The RBA has held the cash rate at 3.6%, with no cuts expected in 2025 after recent inflationary shocks.

- Investor Trends: Units are increasingly attractive for yield and affordability, with growth now matching houses.

ADELAIDE PROPERTY INVESTORS: WHAT SHIFTING INTEREST RATES MEAN FOR YOU

Australia’s interest rate outlook is once again in flux, and for landlords and investors in Adelaide, the implications are significant. With mixed economic signals and global uncertainty, the

Reserve Bank of Australia (RBA) faces a delicate balancing act.

Inflation Pressures vs. Economic Cooling

Inflation remains elevated, especially in services and housing—key sectors for property owners. But signs of economic slowdown, including weaker consumer spending and flat retail sales, suggest the RBA may pause further rate hikes. For investors, this means watching closely: a rate hold could support market stability, while further increases may pressure borrowing costs.

Adelaide’s Housing Market Holds Firm

Despite national uncertainty, Adelaide’s property market continues to show resilience. Low housing supply and strong migration are keeping prices buoyant. For landlords, this supports rental demand and capital growth but also raises the stakes for affordability and tenant turnover if rates climb again.

Global Trends Add Complexity

Internationally, central banks are also navigating mixed signals. While global inflation is easing, geopolitical risks and supply chain disruptions persist. These factors influence Australia’s monetary policy and, by extension, your investment strategy.

Bottom Line

Adelaide’s property market remains attractive, but interest rate uncertainty demands vigilance. Smart investors will stay agile, reassess their portfolios, and prepare for both opportunities and risks in the months ahead.

Our Key Tips

- Rental demand will stay strong due to affordability pressures and limited supply.

- Capital growth prospects in Adelaide are favourable, especially in affordable segments.

- Consider diversification into units or lower quartile properties where demand is strongest.

- Holding assets through 2026 is expected to deliver both yield stability and capital appreciation.

ADELAIDE EDGES PAST MELBOURNE TO BECOME AUSTRALIA’S SECOND LEAST AFFORDABLE CITY

Adelaide has officially edged past Melbourne to become Australia’s second least affordable housing market, sitting just behind Sydney. This shift reflects strong property price growth, limited housing supply, and rising demand from both local and interstate buyers.

For landlords, Adelaide’s affordability ranking presents both opportunity and responsibility. On one hand, rental demand is strong, and property values remain resilient. On the other, tenants are facing growing financial strain. Balancing returns with tenant wellbeing will help sustain positive long-term relationships and protect your investment.

In global terms, all five of Australia’s major cities fall into the report’s highest category of unaffordability. The latest report continues to rank Sydney as the world’s second least affordable housing market, behind only Hong Kong. Sydney’s median house price is now 13.8 times the median household income – what Demographia calls “impossibly unaffordable”. Adelaide’s multiple has climbed to 10.9, pushing it past Melbourne (9.7) and Brisbane (9.3).

The report highlights a sharp turnaround for Adelaide. Just a few years ago, the city’s housing market was among the most accessible in the country. But strong price growth has pushed affordability to record lows. Prices have risen by 9.1 per cent, outpacing both Melbourne and Sydney.

As Adelaide’s market continues to evolve, landlords are well-positioned to benefit from strong rental demand. At the same time, supporting tenants through affordability challenges will ensure sustainable, long-term success.

Thank you for your ongoing support!

Regards David, Benjamin & the Team at DB Philpott Real Estate

We would like to take this opportunity to confirm that we will never ask for payment details in an unsolicited manner. Changes to your account details will always be at your request and verified by a team member in person and must be in writing.