September 2025

Dear Client

WHY THE FEDERAL GOVERNMENT’S HOUSING ACCORD TARGET IS STILL A LONG WAY OFF

July 2025 saw 15,769 dwelling approvals nationally – down 8.2% from June but up 6.6% over the year.

- Houses: 9,429 approvals (+0.6% month, +0.7% year)

- Other dwellings (units, townhouses, etc.): 6,340 approvals (-18.8% month, +16.9% year)

While approvals fluctuate month-to-month, the broader trend is encouraging as house approvals have consistently outpaced units, and overall volumes are rising. Over the 12

months to July 2025:

- 188,727 dwellings approved nationally (+13.4% year, highest annual volume since Jan 2023)

- 112,763 new houses (+5.3% year)

- 75,965 other dwellings (+28.1% year)

But despite this upward trend, volumes remain well below the level needed to meet the Housing Accord target.

The Housing Accord (a federal budget target) aims to deliver 1.2 million new homes between July 2024 and June 2029, that’s around 20,000 approvals per month for five years. Given the target has never been achieved before, and a minimum of 1.2 million homes need to be sought for this to be achieved, it is going to be a challenge, and perhaps an unrealistic goal.

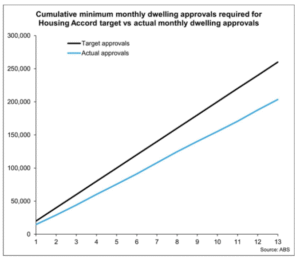

As the graph below shows, actual approvals consistently fall short of the minimum target:

- In the first 13 months, only 203,516 dwellings were approved – a shortfall of 56,484 against the target.

- Not a single month has seen 20,000 approvals; the closest was June 2025, with 17,185 approvals.

Even as interest rates ease and construction costs stabilise, the current pace is unlikely to meet the Accord’s goals. The type of housing also matters:

- Houses and medium-density developments are quicker and cheaper to build than high-density apartments.

- Most approvals are now skewed toward houses, which is a positive trend – but overall volumes are still insufficient.

The country urgently needs more housing delivered quickly, affordably, and in the types Australians want to live in. Current policy levers prioritise high-density inner-city housing,

which:

- Takes longer to finance and construct

- Costs more than single houses or townhouses

- Delays supply reaching the market

A more effective approach would focus on greenfield and “missing middle” medium-density developments to speed delivery and reduce costs. Governments should also:

- Streamline approval processes

- Remove barriers slowing construction

- Encourage new housing supply rather than measures that push up demand for existing housing

While approvals are rising, without a laser focus on speed, cost, and the right housing types, the Housing Accord target remains out of reach.

Leaders in property and policy need to look beyond headline numbers and consider how housing delivery can be accelerated and made more affordable.

FEDERAL GOVERNMENT'S HOME GUARANTEE SCHEME

The fast-tracked expansion of the federal government's Home Guarantee Scheme, effective from October 1, is set to significantly increase the range of suburbs available to first home

buyers. The scheme, which allows eligible first home buyers to avoid lenders mortgage insurance while purchasing a home with a 5% deposit, will now remove income and place limits, while

also raising property price caps across most regions.

Under the old price caps, around a third of the 4,848 house and unit markets analysed nationally had a median value below the respective limits.

Under the expanded limits, this portion jumps to 63.1%, including 51.6% of house markets and 93.7% of unit markets.

Cotality Economist Kaytlin Ezzy says the new settings will empower first home buyers with greater choice, while helping to level the playing fields for those without access to the bank

of mum and dad.

“Previously, to qualify for the scheme, first home buyers were largely restricted to more affordable housing options, including units and houses in outer mortgage belts and regional

markets”.

Ms Ezzy added that choices in Brisbane and Adelaide were also largely limited to units, with only 36.9% and 41.3% of suburbs respectively falling under the old caps.

“Since the caps were last revised in 2022, values across the mid-sized capitals have grown significantly, which has seen first home buyers reliant on the scheme to purchase a house,

essentially priced out.”

Across Sydney and the Illawarra and Newcastle and Lake Macquarie regions, the cap has increased by $600,000 to $1.5 million. In Southeast Queensland and Adelaide, the caps have both increased by $300,000 to $1 million and $900,000 respectively.

The expanded scheme provides a marked increase in options

- Nationally, just over half of house markets (51.6%) now fall under the new price caps, and 93.7% of unit markets.

- Adelaide saw the largest increase for houses, with 46.6% of suburbs (130) now qualifying, up from just 2.9% (8) previously.

- Brisbane saw the largest proportional increase for units, with 97.5% of suburbs (153) now qualifying, up from just 36.9% (58).

“While this is a demand-side policy that will undoubtedly put some upward pressure on values, it will help create a more equitable starting point and provide more options for those looking to get on the property ladder,” Ms Ezzy said.

OPINION

Putting these two schemes together is challenging!

The Housing Accord target is very ambitious, and supply bottlenecks are real and complex.

The Housing Accord target is aspirational and achieving it requires coordination across federal, state, territory & local governments, as well as regulatory reform, funding, workforce

capacity, etc.

The 5% guarantee can provide relief for some buyers but unless there is a major lift in supply (and/or structural reforms to reduce costs), it may just shift the problem around — making housing more expensive overall or creating more risk for both households and government (don’t forget the scheme involves government guarantees & underwriting risk).

The 5% guarantee scheme helps with frontend affordability (deposit, LMI etc), but it doesn’t directly reduce the cost of building homes, fix planning bottlenecks, or increase supply of well located housing. Without those, affordability issues persist.

Unless demand management (e.g. via migration, or smoother demand stimuli) is balanced with serious supplyside work, the gap to the Accord’s target will likely keep growing and home ownership falls further out of reach (even with the 5% guarantee)

Thank you for your ongoing support!

Regards David, Benjamin & the Team at DB Philpott Real Estate